Personal Savings Planning

Possibilities You Won't Hear From Your Advisors...

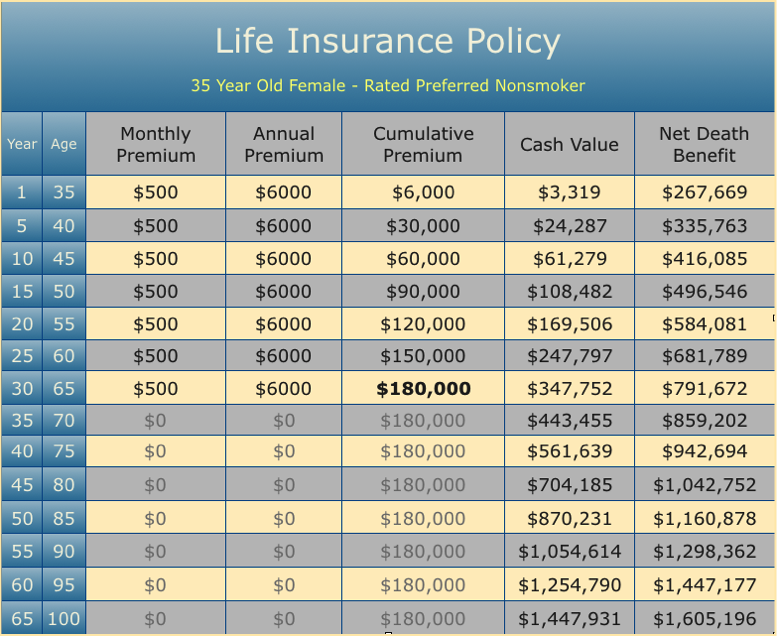

money during your lifetime and especially during & through the end of your retirement is important to you, this idea below may be worth considering as the money you worked so hard for will not lose value due to the markets. In this example a 35 year old female contributes just $500 per month for 30 years then stops at age 65. Unlike Qualified Plans or even Bank CD's, the Cash Value can be accessed at any time along the way without a fee and for any purpose Tax-Free and no application or income verification is required. Try obtaining a home equity loan without an application let alone income verification. So if you get hurt, become ill or simply lose your job and need cash, owning your home free & clear may not help you.

These plans also includes a waiver of premium rider so in the event she became disabled, the insurance premium will be paid until she returned to work or will be paid in full if she became permanently disabled. Really? YES and unlike a Qualified Plan, CD or Bank Savings account, this plan offers a Death Benefit payable to her heirs Tax-Free when the inevitable finally occurs, and sadly it will eventually occur. But what a great gift to pass on to your loved ones, and what did it really cost her after several years? (See Cumulative Premium vs Cash Value below)

Zip-Zilch-Zero > Nothing!

Something to think about...

Knowing you need to save money for your future retirement, you save $500 per month or $6000 per year in your savings account for 30 years. (SEE TABLE BELOW) Your 30 years of contributions (DEPOSITS) is $180,000 which is less than the first years death benefit this person below would have left her family should she pass on. And she only contributed $500 - $6000 that year. A fairly substantial return on her investment, wouldn’t you say? Now I’m finding it hard for anyone to take me up on this 1 year strategy however the likelihood of her living a nice long life is fairly good and you can see how those numbers continue to grow. $561,639 in her cash account and $942,694 to leave her loved ones after 40 years and just by saving $500 per month for 30 years. All the while having total Liquidity, Use and Control of her money from day one. No withdrawal fees, no taxes and no one standing between her and her hard earned money and NO LOSSES DUE TO THE MARKETS.

We believe a properly designed Life Insurance-Based Financial Plan is the best place to store cash for your Emergency, Opportunity and Retirement Necessities. You just simply need to ask us why.

So please, tell me again why 401k, 529 & IRA plans are so popular?

* Values could be more or less depending on interest rates and dividends received during the contract period, as well as the health of the applicant. We can demonstrate any number of examples depending on your age, health, premium amount, number of years you wish to contribute to your plan, etc: Everyones plan will be somewhat different (better or worse) due several factors.

If having enough

Talk about opportunity, see what businesses got started by borrowing against their Life Insurance Cash Values "Click Here"