Realistic Debt Management

At some point in our lives, most of us have borrowed beyond our means. If you're in over your head, know that there is a way out, but make no mistake, you must FIRST learn to live on less than what you earn. Getting out of debt takes discipline, and that is why you’ll need a plan to give you step-by-step instructions on how to get your debt under control.

Our job is to find money you are already giving away UNKNOWINGLY OR UNNECESSARILY and apply this new found money to your debts, assets and lifestyle. It’s akin to plugging a hole in your boat or the gas tank under your car. How soon would you want to know those holes were there and how fast would you want them plugged up? ...drip-drip-drip

Impulse shopping and trying to keep up with the Jone’s, (which by the way, may just take you down with the ship), is just the beginning of the financial landslide. The fact is that the average family household is shelling out approximately 34% of their net income just to pay the interest on their debts.

Financing Costs Are A Big Reason For Empty Bank Accounts!!

Having our money tied up in supposedly Tax Favored Accounts, requires us to go elsewhere for cash when we need to purchase necessities like automobiles, home repairs etc., or have an emergency, because we have lost our LIQUIDITY, USE and CONTROL of our own money!! That alone should be enough to make you SICK!! How would you like a 34% raise?

Once you’ve recognized that you need to make changes, you have turned the corner towards debt free living and now simply need to identify the 9 Financial Land-Mines that has plagued many of us over the years. Patrick Kelly talks about these land mines in his book “Tax-Free Retirement”, (found under the Wall Street Alternative tab), and is an Absolute must read for anyone unsure of where their money goes.

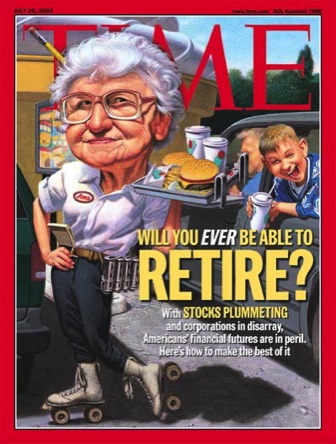

The ideas and information we offer, will explain why utilizing a unique Debt Elimination strategy into your personal financial plan, will start you on a path to understanding the devastating effect debt can have on us. We will show you how to get your money working for you (compounding gains & accumulating assets), instead of having your debts work against you (paying interest, fees & late charges), which leads to increasing “LOST OPPORTUNITY COSTS”, lowering your chances of enjoying retirement.

Custom Strategies

We can suggest a unique debt plan for each of our clients based on the real time movement of their dollars. We find ways to make each dollar count, and show how a penny saved today can turn into dollars earned in the future. It’s called “Triple Compounding” or “The 3 Miracles of Compound Interest”. Interest on principle, Interest on Interest, and Interest on the Tax Dollars you would have paid, had you’d placed your money in a TAXABLE ENVIRONMENT. (Eck)

However, as you know, there is more than one way to skin a cat (where in the world did that phrase come from?), so what works well for some may not for others. We’ll simply give you options and by starting this process now, you will be well on your way to Taking Control of your money > (Faster Than Your Kids Gettin’ Into The Cookie Jar)

*** And for Pete's Sake, who else would you want to be in control of YOUR Hard Earned Money?

Social Security

If you're turning 65 soon or if you would like to see if your existing Medicare Plan is the best option for you, wander over to Medicare.gov by clicking on the image > then give us a call and we'll answer any questions you may have and our service is FREE...

Your visit with us can take into account your full retirement picture so that we can provide you with a SOCIAL SECURITY MAXIMIZATION REPORT that is built specifically for your situation. Are You Leaving Money On The Table? There can be as much as $300,000 difference by choosing the wrong strategy. One of the biggest mistakes made by Baby Boomers is taking Social Security too early. The rules are complicated, especially when a spouse or ex-spouse is involved. Make sure you get with an advisor who has the tools to get you all of the options available.

Medicare

Now, if you haven’t already visited the Wall Street Alternative page next door, you may do so by selecting the link here, above or below.

Social Security Administration provides you with:

• 567 ways to claim your benefits...

• ZERO employees to advise you on the best strategy...

• One chance to get this right (after 12 months, there are no “do-overs”).

If what you thought to be true about Money, turned out not to be true, when would you want to know? Have you ever made an error in judgment, found out later and said Uh-Oh? We all have, but we also know that “when the student is ready, the teacher will appear”.