15 vs 30 Year Mortgages

Did You Know?

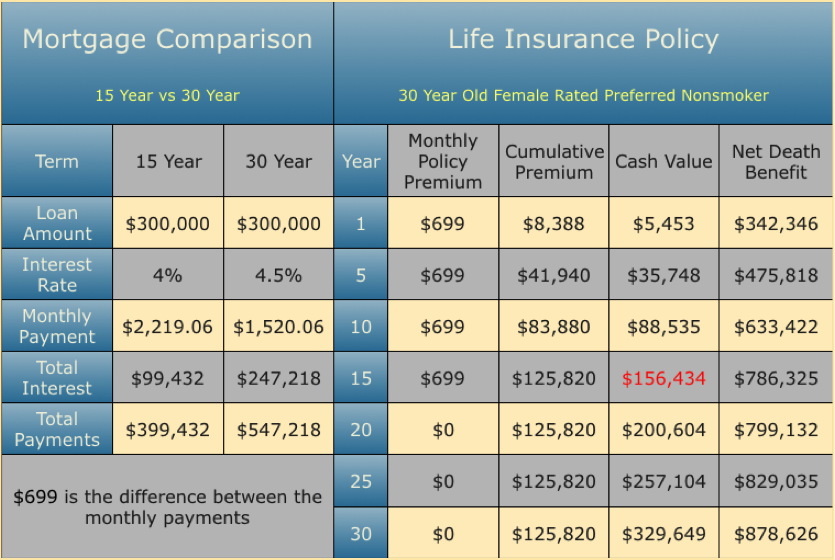

it is smarter to payoff your home mortgage as fast as you can and it may be for a few, however here is another way you can look at it. Let's compare a 30 year old female purchasing a $300,000 home using a 15 year mortgage @ 4% vs a 30 year mortgage @ 4.5% & contributing the additional $699 she would need to spend on the 15 year note per month into a Life Insurance Contract for just 15 years.

Using a 15 year mortgage she would save $147,786 in Total Interest Charges over a 30 year Loan, however by utilizing a properly designed Life Insurance Contract and a 30 year mortgage, by the end of just 15 years she would have accrued $156,434 in a Cash Account and in 30 Years that number could increase to $329,649, which she could use for any purposes. [No Questions Asked] And you have to agree that most people would not have saved that much over and above their mortgage payment in the 15 year scenario since they are already paying $699 more than they would in the 30 year example.

She would also have approximately $786,325 in Death Benefits after just 15 years and $878,626 after 30 years - Available to her heirs Tax-Free. Her family would not have to sell their home just to get by.

The 30 year Mortgage / Life Insurance Strategy offers access to money not available with the 15 year mortgage. (No application or income verification needed) Not to mention 15 years of Mortage Interest Deductions she would lose utilizing the 15 year mortgage in lieu of the 30 year mortgage.

This also includes a waiver of premium rider so in the event she became disabled, the insurance premium will be paid until she returned to work or will paid in full if she was permanently disabled. Really?

* The Death Benefit alone would payoff the mortgage on day 1 if death occurred *

Many People Believe

* Values could be more or less depending on interest rates and the dividends received during the contract period. Also tax considerations should be looked at as you may save even more using this strategy.

Not a believer yet? Check out Warren Buffett's story by traveling over "Here".